2022 annual gift tax exclusion amount

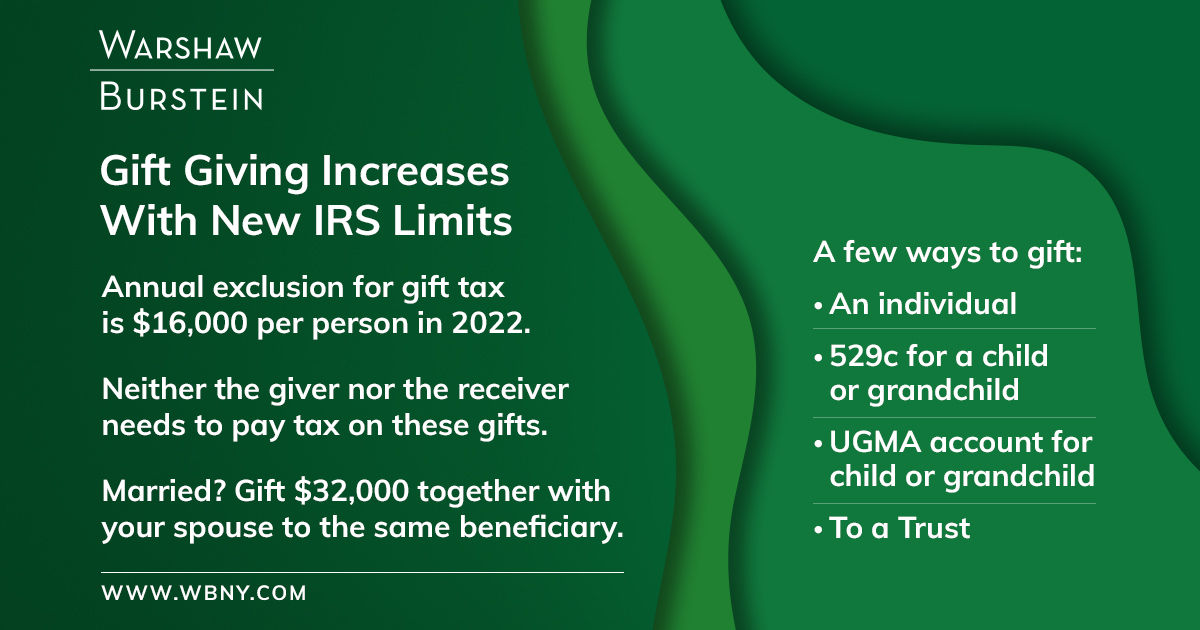

In 2022 the annual gift tax exemption is increased to 16000 per beneficiary. If you want to avoid paying the gift tax stay below the annual exclusion amount which is 16000 in 2022 up from 15000 in 2021.

Opinion Don T Have 13 Million The Lifetime Estate And Gift Tax Exemptions For 2023 Still Matter Marketwatch

How the lifetime gift tax exclusion works.

. And because its per person. For Estate Tax returns after 12311976 Line 4 of Form 706 United States Estate and Generation-Skipping Transfer Tax Return PDF lists the cumulative amount of adjusted taxable gifts within. The publication of this revenue.

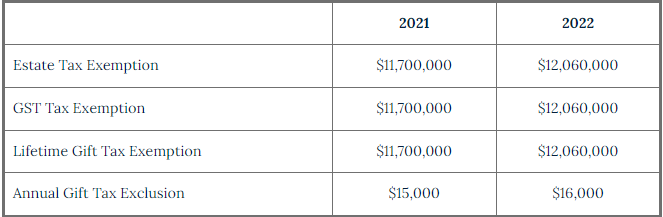

Further the annual amount that one may give to a spouse who is not a US citizen will. For 2022 the current amounts for each taxpayer are. The 2021 exemption amount was 73600 and began to phase out at 523600 114600 for married couples filing jointly for whom the exemption began to phase out at.

The gift tax does not play a significant role in the finances of most Americans because of two key IRS provisions. On top of the 16000 annual exclusion in 2022 you get a 1209 million lifetime exclusion in 2022. The annual gift tax exclusion is the amount of money or assets that one person can transfer to another as a gift without incurring a gift tax.

Estate and Gift Tax Exemption. Gifts that are worth more than that amount. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax.

This increase means that a married. In addition in 2022 the gift tax annual exclusion amount for gifts to any person other than gifts of future interests to trusts will increase to 16000 while the gift tax annual. Gift Tax Annual Exclusion.

The right of withdrawal is generally limited. For 2022 the current amounts for each taxpayer are. With proper planning or use of portability this means that a married couple has a combined exclusion amount of 2412 million.

Due to the rise in inflation this past year Revenue Procedure 2022-38 was just recently released announcing the new estate and gift tax exemption amount as well as the new annual exclusion. The estate and gift tax rate remains the same in. The estate and gift tax rate remains the same in.

Gifts to beneficiaries are eligible for the annual exclusion. The gift tax annual exclusion in 2022 will increase to 16000 per donee. The exclusion will be 17000 per recipient for 2023the highest exclusion amount ever.

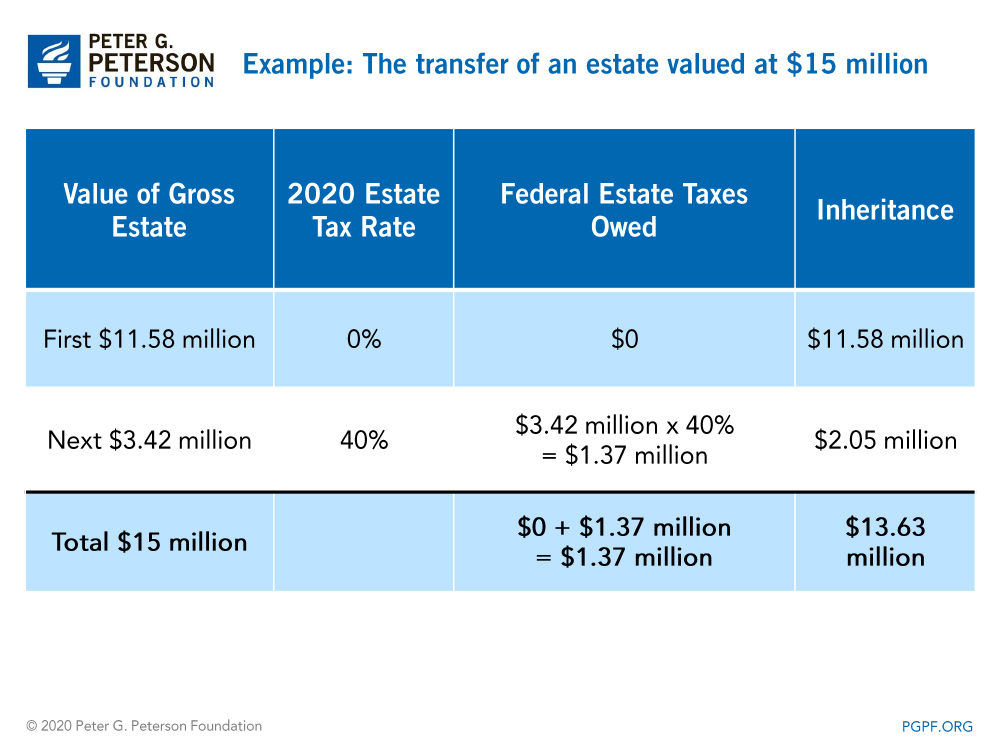

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. In addition to the lifetime gift and estate tax exemption the Internal Revenue Code allows donors to gift up to 16000 in 2022 to each of an unlimited number of recipients. Each spouse is entitled to the annual exclusion amount on the gift as shown in the table.

Gift tax rules for 2022 onwards. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax. The annual gift tax exclusion and lifetime exemption.

If you managed to use up all of your exclusions you might have to pay the gift tax. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person.

Annual Gift Tax Exclusion A Complete Guide To Gifting

Gift Tax Limit 2022 How Much Can You Gift Smartasset

New Exemption And Annual Exclusion Amounts For 2022 Hallock Hallock

Changes To 2022 Federal Transfer Tax Exemptions Lexology

Gift Tax And Other Exclusions Increases For 2022 Henry Horne

Warshaw Burstein On Twitter Gift Giving Increases With New Irs Limits The Annual Exclusion For Gift Tax Is 16 000 Per Person In 2022 There Are A Few Ways To Gift Where Neither

Annual Gift Tax Exemption 2022 Video Litherland Kennedy Associates Apc Attorneys At Law

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

2022 Tax Inflation Adjustments Released By Irs

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Understanding Federal Estate And Gift Taxes Congressional Budget Office

New Estate And Gift Tax Laws For 2022 Youtube

Annual Gift Tax Exclusion Increases In 2022

2017 Estate And Gift Tax Limits Marotta On Money

Warshaw Burstein Llp 2022 Trust And Estates Updates

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset