tax sheltered annuity vs 403b

403 b Plans Today 403 b plans are similar to 401 ks in that they allow employees at eligible. Choose From Over 60 Funds With 4 5 Star Ratings From Morningstar.

Taxsheltered Annuity Plans Also Known As 403b Plans

According to the IRS the annual contribution limit is 19500 in 2021 and rises to 20500 for 2022.

. What is a tax-deferred annuity plan. Get Free Quote Compare Today. 403b plans are also known as tax-sheltered annuities tax-deferred annuities or annuity contracts Because 403b plans may not resemble what we typically think of as a.

IRC 403 b Tax-Sheltered Annuity Plans - Overview of the 403 b Final Regulations On July 23 2007 the first comprehensive regulations in 43 years were issued published July. Tax-Sheltered Annuity Plans 403b Plans For Employees of Public Schools And Certain Tax-Exempt Organizations. A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers.

Ad Learn More about How Annuities Work from Fidelity. Just like a 401 k plan a 403 b tax-sheltered annuity plan gives employees the option to defer some of their salary into into individual tax deferred investment accounts. A 403 b plan.

20 Years Experience Providing Expert Financial Advice. A tax-deferred annuity TDA plan is a type of retirement plan designed to complement your employers base retirement plan. Ad Get up To 7 Guaranteed Income with No Market Risk.

Ad Experienced Support Exceptional Value Award-Winning Education. A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities. Learn some startling facts.

457b Tax Sheltered Annuity. Whereas 401 k plans are provided by for-profit companies only organizations that meet Section 403 b of the Internal Revenue Code can offer tax-sheltered annuity plans. Ad Get this must-read guide if you are considering investing in annuities.

Strategies Across the Risk and Reward Spectrum. Employees of specific nonprofit or public organizations may. TD Ameritrade Offers IRA Plans With Flexible Contribution Options.

Achieve Your Financial Well-Being With Courage Strength Wisdom. Annuities are often complex retirement investment products. Ad Learn More about How Annuities Work from Fidelity.

An employee may elect to transfer funds from an existing 403b plan to a new 403b plan according to the plans guidelines and IRS regulations. Contribution limits for 403 b plans are the same as for 401 ks. Ad Learn How a 403b Can Help Prepare You for a Comfortable Retirement Online Today.

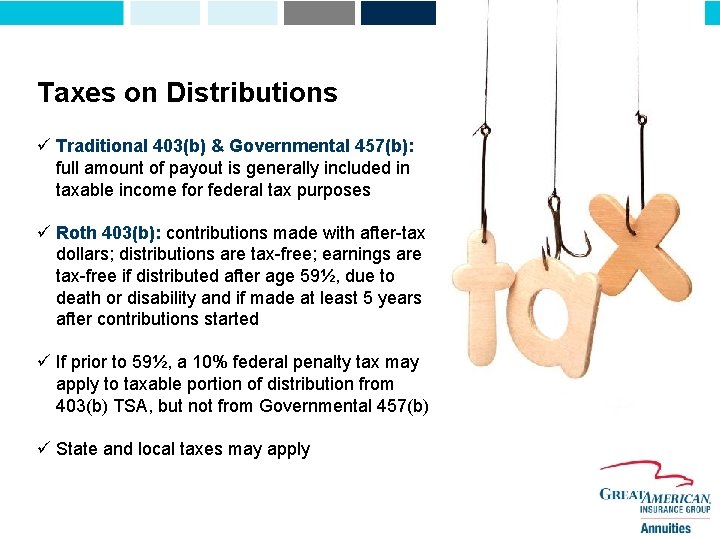

Ad Access Our Thought Leadership for Articles and Special Reports on Asia. Differences in Plan Taxes. Pursue Your Financial Goals.

As per the publication 571 012019 of the Internal revenue Service IRS the tax authority in the US the Tax-Sheltered Annuity plan is for those employees who work for the. How Much Income Does An Annuity Pay. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations.

So while the name tax-sheltered annuity lingers its a bit of a misnomer. Ad Start By Choosing the Goal For Your Investment. Tax Sheltered Annuity 403b Deferred Compensation 457 General Description A retirement income vehicle which allows eligible employees to defer taxation savings to future years.

A 403 b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of. IRS Publication 571. A document published by the Internal.

Sometimes a TDA plan is also. 403 b Plan Publications Publication 571 Tax-Sheltered Annuity Plans for Employees of Public Schools and Certain Tax-Exempt Organizations Publication 575 Pension and Annuity Income. An Overview of Tax-Sheltered Annuities An example of a tax-sheltered annuity is the 403 b plan in the US.

Open an Account Today. A 403 b plan is a retirement plan for specific employees of public schools tax-exempt organizations and certain ministers. These plans can invest in either annuities or.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

The Tax Sheltered Annuity Tsa 403 B Plan

403b Vs Roth Ira Which Retirement Plan Suits You The Best Wealth Nation

Taxsheltered Annuity Plans Also Known As 403b Plans

Roth Ira Vs 403b Which Is Better 2022

403b Tsa Annuity For Public Employees National Educational Services

Difference Between 401k And 403b Retirement Plans Ask Any Difference

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

403b Vs Roth Ira Which Retirement Plan Suits You The Best Wealth Nation

Massmutual What S In A Name A Retirement Plan Comparison

Withdrawing Money From An Annuity How To Avoid Penalties

403b Withdrawal Rules Pay Tax On Retirement Income

Qualified Vs Non Qualified Annuities Taxation And Distribution

Taxsheltered Annuity Plans Also Known As 403b Plans

Tax Sheltered Annuity Faqs Employee Benefits

Withdrawing Money From An Annuity How To Avoid Penalties

Taxsheltered Annuity Plans Also Known As 403b Plans